- #EXCEL PERSONAL FINANCE BUDGET WORKBOOK VEI HOW TO#

- #EXCEL PERSONAL FINANCE BUDGET WORKBOOK VEI SOFTWARE#

Participating in the creation of financial forecasts

#EXCEL PERSONAL FINANCE BUDGET WORKBOOK VEI SOFTWARE#

The Senior Financial Analyst participates in the financial planning cycle preparing analyses on the income statement, balance sheet and cash flow statement preparing and consolidating financial forecasts completing key reports/analyses and communicating their significance to various levels of management preparing capital investment analysis or other special analyses for mergers and acquisitions working with financial models using various software participating in team and individual financial projects and the financial closing cycle and supporting staff members when needed The perfect candidate has several years FP&A experience heaving experience with financial modeling strong excel skills. If you are stuck on what to do, read the articles on formulas and functions, and Visualizing data using charts in Excel.What are the 3-4 non-negotiable requirements of this position?

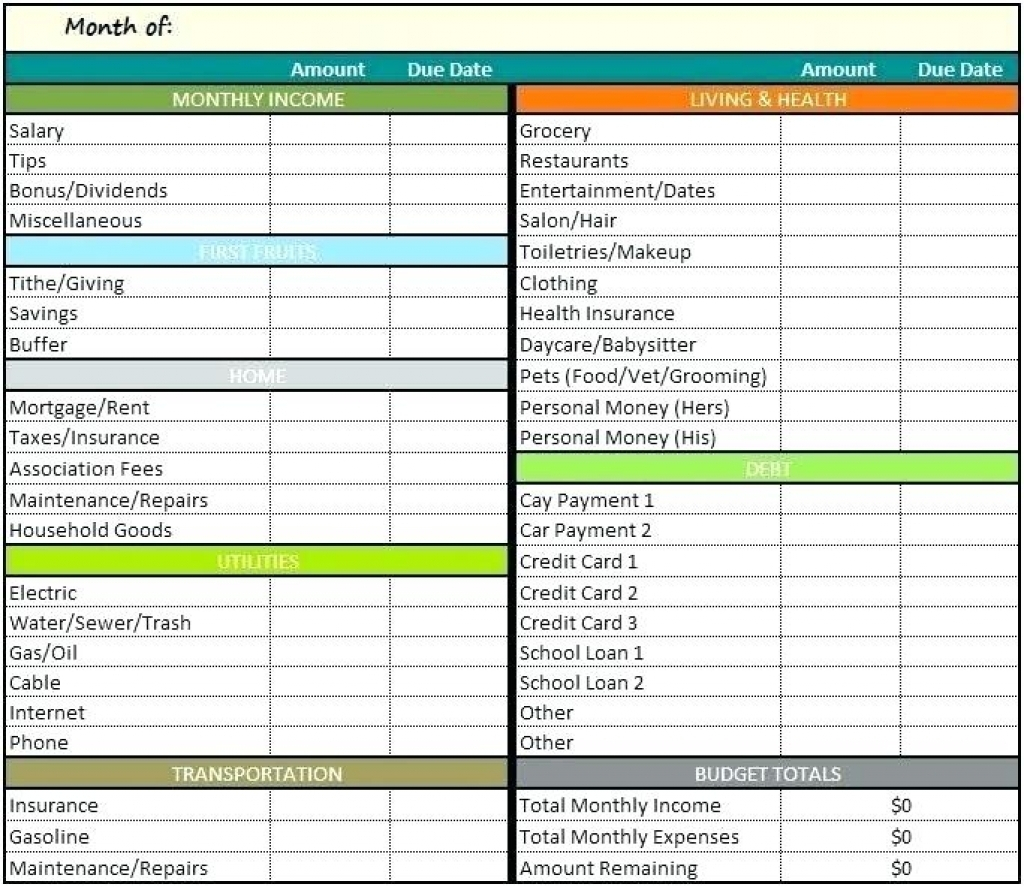

Add a comments row just below the tables.Find the income variance by subtracting the projected annual income from the actual annual income.Find the annual projected and actual income by multiplying your answer in question 1 by 12.Do this for both projected and actual monthly income to manage personal finance in Excel. Find the sum of all monthly income sources.Use conditional formatting to highlight how well we are managing our finances.Show tips on how we are doing using logical functions.Find the variance between the actual and project annual income.Compute the projected annual income and actual annual income based on the monthly total.Calculate the monthly income for both projected and actual income.The variance between the budget and the actual expenditure give us the performance indicator of how disciplined we are when it comes to sticking to a budget. The variance between the projected income and actual income gives us the performance indicator of how accurate our estimates are or how hard we are working. Actual expenditure – this is the money that you actually spend buying things.Actual income – this is the actual money that you earn as time progresses.Budget – this is a list of the items that you expect to buy, quantities and their respective prices.Projected income – this is the money that you expect to earn now and in the future.This is a basic personal finance system so we will consider the following components In order to be financially successful, one needs to develop a habit of spending less than they earn and invest the surplus in business ventures that will multiply the invested money Major components of a personal finance system If we do not manage our personal finances properly, then all of our efforts go to waste. We go to school to get a good job, engage in business and other related activities with the main goal of making money. Let’s face it, the world we live in is fuelled by money. Using Excel to set personal budgets, record income and expenses.Major components of a personal finance system.

#EXCEL PERSONAL FINANCE BUDGET WORKBOOK VEI HOW TO#

In this tutorial, we are going to look at how to use Excel for personal finance to properly manage our budget and finances. It takes discipline to use money properly. Used properly it makes something beautiful- used wrong, it makes a mess!” – Bradley Vinson

0 kommentar(er)

0 kommentar(er)